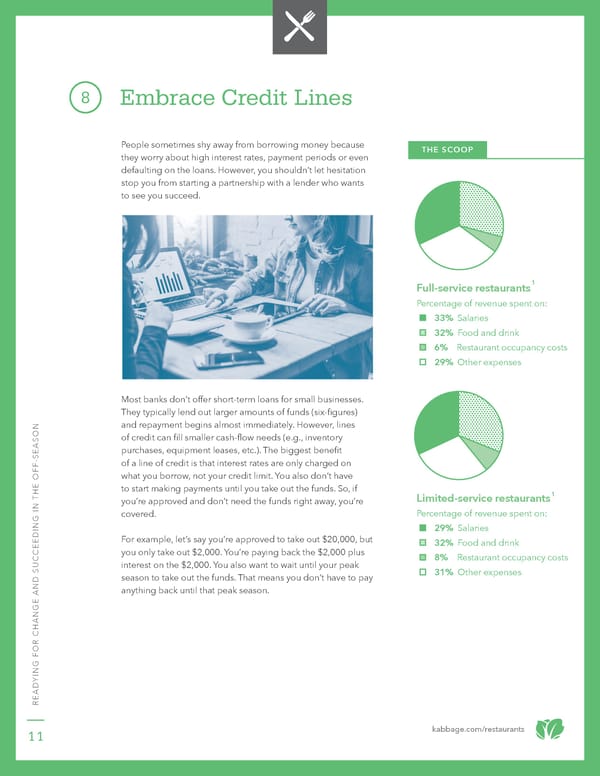

8 Embrace Credit Lines People sometimes shy away from borrowing money because THE SCOOP they worry about high interest rates, payment periods or even defaulting on the loans. However, you shouldn’t let hesitation stop you from starting a partnership with a lender who wants to see you succeed. Full-service restaurants1 Percentage of revenue spent on: 33% Salaries 32% Food and drink 6% Restaurant occupancy costs 29% Other expenses Most banks don’t offer short-term loans for small businesses. They typically lend out larger amounts of funds (six-figures) and repayment begins almost immediately. However, lines of credit can fill smaller cash-flow needs (e.g., inventory SEASON purchases, equipment leases, etc.). The biggest benefit - of a line of credit is that interest rates are only charged on what you borrow, not your credit limit. You also don’t have THE OFF to start making payments until you take out the funds. So, if Limited-service restaurants1 you’re approved and don’t need the funds right away, you’re covered. Percentage of revenue spent on: 29% Salaries For example, let’s say you’re approved to take out $20,000, but 32% Food and drink CEEDING IN you only take out $2,000. You’re paying back the $2,000 plus 8% Restaurant occupancy costs interest on the $2,000. You also want to wait until your peak 31% Other expenses season to take out the funds. That means you don’t have to pay AND SUC anything back until that peak season. YING FOR CHANGE READ 11 kabbage.com/restaurants

10 Steps to Make the Most of Your Restaurant’s Seasonality Page 11 Page 13

10 Steps to Make the Most of Your Restaurant’s Seasonality Page 11 Page 13